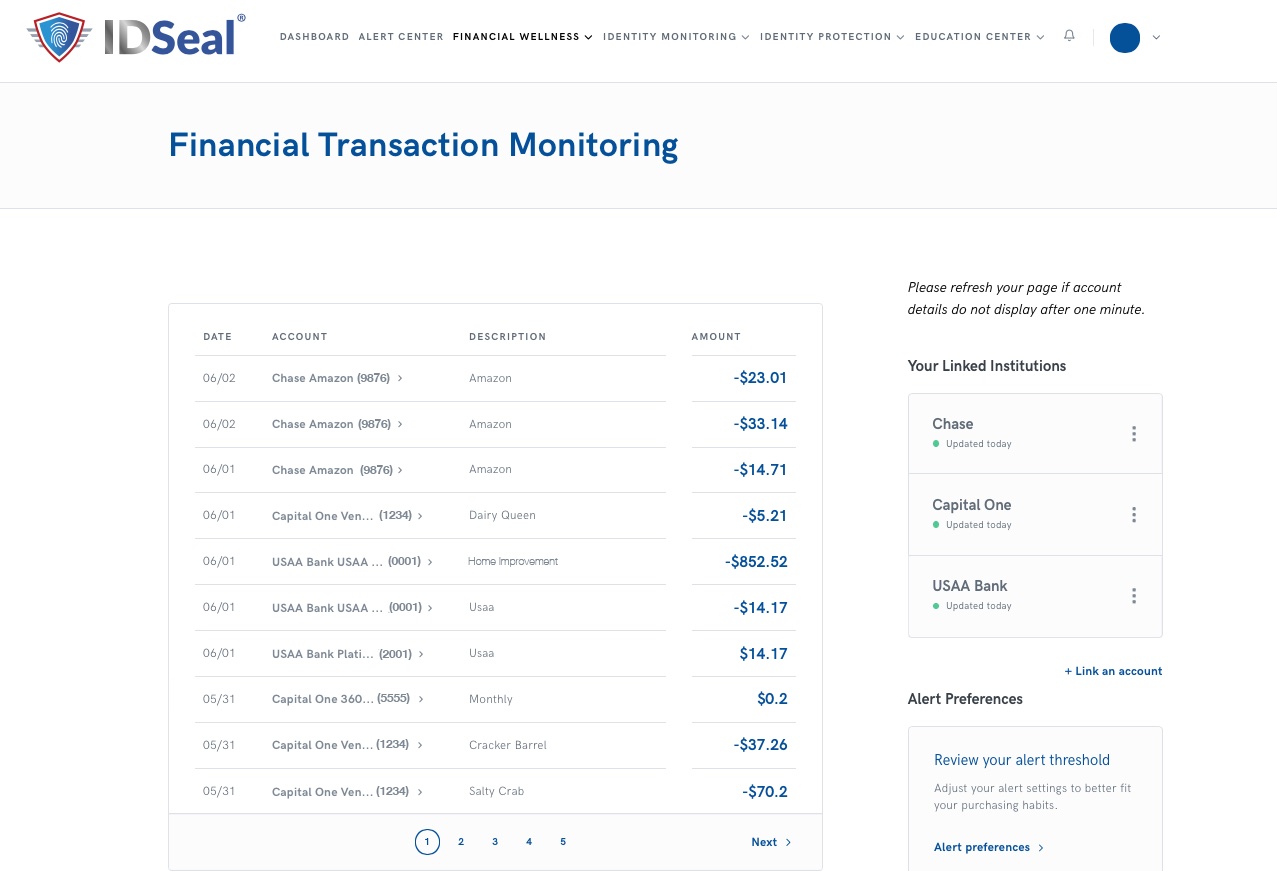

IDSeal recently released a new feature to its identity theft protection suite: Financial Transaction Monitoring. Utilizing this feature will help you stay on top of all of your accounts without having to track each one.

What does Financial Transaction Monitoring do?

Financial Transaction Monitoring monitors any checking, savings, investment, and retirement accounts, as well as credit cards that you link. When there are large transactions, low balances, or potentially fraudulent activity is detected, you’ll get alerted.

The best part of this feature is that you can view all of your connected accounts in one place, instead of having to login to each individual financial institution to keep track.

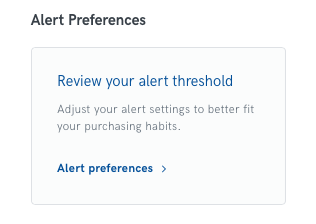

Speaking of alerts… can you change your alert preferences?

Yes! You may want to adjust your alert threshold to best reflect your purchasing habits. On the Financial Transaction Monitoring page, you can select “Alert preferences” and modify at what dollar amount per transaction type that you wish to receive alerts.

Why should you be monitoring your transactions?

Being on top of your financial accounts is highly recommended, especially since identity theft and fraud are at an all-time high. A fraudulent transaction doesn’t have to be large, so having insight on everything that happens is to your advantage and a proactive way to approach your financial security.

Not only are you being proactive to avoid fraud, but you are also keeping track of the state of your connected accounts: large transactions and low balances.

So, the million dollar question is this: Have you set Financial Transaction Monitoring up on your account yet? If not, let’s dive in to how you can set up this feature today!

- Login to your member portal

- Select “Financial Wellness” from the menu at the top

- Select “Financial Transaction Monitoring” from the drop-down

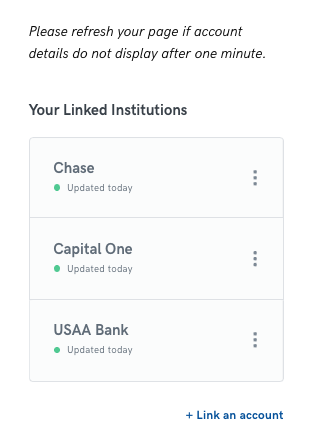

- Select “Link an account”

- Select “Start linking”

- Find your bank(s)

- Accept the terms & conditions

- Securely sign-in with each bank you wish to connect

Once you’ve completed the steps above, IDSeal immediately begins monitoring your connected accounts. It’s that simple!

What if I want to remove an account that I’ve connected?

On the Financial Transaction Monitoring page, you can select the ellipses next to your Linked Institution and select “Delete Institution”.

In conclusion, we know that staying on top of all of your accounts and protecting your identity can feel complicated or difficult, but IDSeal simplifies that with Platinum and Platinum Plus subscriptions. Not an IDSeal Subscriber yet? Go to Plans & Protection to choose a plan that is right for you.

It is not possible to prevent all identity theft or cybercrime, or to effectively monitor all activity on the internet. IDSeal cannot and does not guarantee complete protection against cybercrime or identity theft. IDSeal does not monitor the activities of all financial institutions, or all activities of any particular financial institution.

IDSeal Pro-Tec provides tools and resources to protect your data and identity, but no one can prevent all cybercrime or identity theft. Your own efforts are important to prevent unauthorized access to your personal information.

Start protecting your identity today! Signing up is quick & easy

Remember, 1-in-4 Americans are the victim of identity theft. It's not a matter

of if you'll become a victim, it's when...