News reports may often give the impression that mostly older Americans are at the greatest risk of identity theft and fraud, but anyone can become a victim. Unfortunately, identity theft is not uncommon. Nearly 33% of Americans face some form of identity theft attempt in their lives. It’s estimated that every 22 seconds a cybercriminal succeeds in stealing someone’s identity, and cyber security experts anticipate the number to rise.

As technology develops, the methods cybercriminals use to access your personal and financial information have become more sophisticated. From online shopping scams to data breaches, cybercriminals use various strategies to scam victims out of cash or access personal and financial information to sell on the dark web.

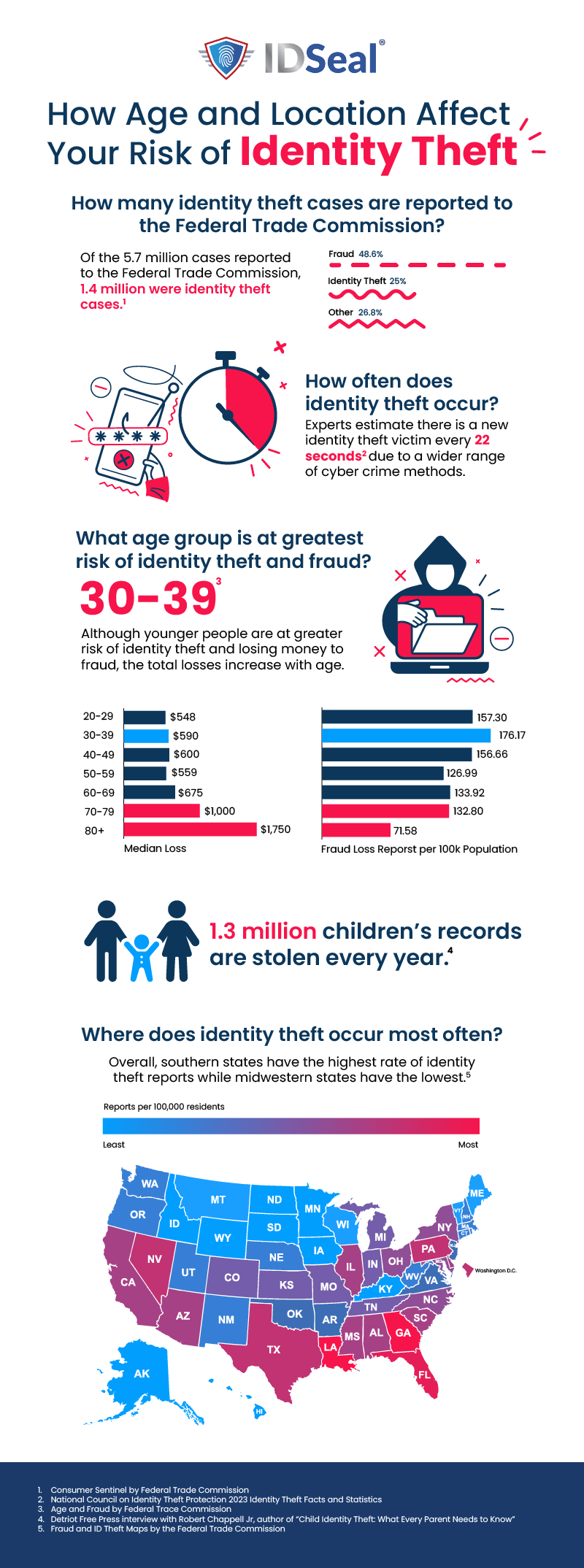

Even though everyone is a potential target, your age and location can influence the ways in which fraudsters gain access and how much you could lose.

Knowing your risk factors can help you thwart an attempt to steal your identity and money. Check out this infographic for some surprising statistics.

What Age Group is at Greatest Risk for Identity Theft?

As the generation with the largest population in the United States, Millennials aged 30-39 report the highest numbers of identity theft and fraud to the Federal Trade Commission in 2022.

Although more younger people report losing money than older people, the average monetary loss increases with age. Young people between the ages of 20-29 lost an average of $548. Meanwhile, those between the ages of 70-79 lost roughly $1,000, and those over 80 lost more than double the youngest at $1,750.

Children under the age of 18 are also at risk for identity theft. More than 1.3 million minors’ records are stolen each year, and half of the victims are younger than 6 years old.

Children’s records are particularly appealing because the child’s Social Security number serves as a clean slate, and parents are rarely monitoring their children’s credit activity. These records provide the perfect starting point to create a synthetic identity. With this new persona, fraudsters can apply for government benefits, open a bank account or credit card account, apply for a loan, sign up for utility services, and rent a place to live all with the child’s Social Security number. The financial damage from childhood identity theft often goes undetected for years until the child turns 18 and seeks a loan or credit card for the first time.

Where Does Identity Theft Occur Most Often in the United States?

Unsurprisingly, when looking at the total number of reports of identity theft per state, we see a clear trend falling in line with population. The most populous states tend to have the highest total numbers. However, when we look at the reports per capita, the rankings for the state with the highest rate of identity theft for 2022 shift with some surprising results.

Georgia had the highest rate of identity theft, followed by Louisiana, and Florida rounding out the top three.

Florida is the third most populous state and has the highest percentage of senior citizens, so its spot might not surprise you. On the flip side, Maine has the highest median age of any state, yet it has one of the lowest rates of identity theft. Meanwhile, Georgia is the eighth most populous state with a median age of 36.9. These results buck the notion that elderly Americans are the most common victims of identity theft.

Overall, southern states have the highest rate of identity theft reports while midwestern states like South Dakota, Wyoming, and Iowa tend to have the lowest. It’s worth noting that the states with the lowest rates of identity theft also have lower populations.

How to Protect Your Identity from Fraudsters

Sadly, the threat of identity theft is only increasing as every aspect of our lives becomes more intertwined with technology. Individuals and organizations handling sensitive data must stay vigilant to protect the data cyber criminals use to commit identity theft and fraud.

Here are a few ways you can take control of your data:

- Know the signs of phishing and spoofing. The point of access can vary from malicious links on the internet to a phone call or email from a business you know. Scammers go to great lengths to lull you into their trap whether that through your established trust with a known brand or social engineering to get you to act quickly and without thinking. When entering your personal information online, always be certain you can trust the website. Be wary of attachments and links in emails. If you receive a phone call from a representative asking for personal information, politely hang up and call a known number.

- Use strong and unique passwords on all accounts. Avoid recycling passwords for all your accounts, including social media. Add multi-factor authentication options, like adding your phone number to receive login codes, to any account that offers it or use an authenticator app.

- Monitor your credit, financial, and medical accounts. Monitor your credit and the credit of your children as soon as possible to find any suspicious activity. Many credit card companies offer this service, but you can monitor all your credit, financial, and medical accounts in one place with IDSeal. You can also keep an eye on social media and track local sex offenders with IDSeal, giving you and your family online and offline security.

- Protect your paperwork and devices. Mail theft can also lead to identity theft, so be sure to grab your mail daily. It’s also wise to shred all physical documents with sensitive information like your Social Security number before hauling it to the curb. If you store any digital documents on your computer or other devices, you can encrypt them with IDSeal Pro-Tec, a 16-feature device protection app that comes with any IDSeal plan you select.

- Consider identity theft insurance. Identity theft insurance can provide additional protection in case you or your family member becomes the victim of identity theft. With up to $1 million for eligible losses and fees, access to recovery specialists, and $500 in lost wallet protection, IDSeal members can breathe easy knowing they have the most complete identity theft protection on the market.

If you aren’t protecting your devices, monitoring your accounts, or leveraging identity theft insurance, mitigating your risks of identity theft and fraud can be more difficult. Learn how IDSeal can help.

Start protecting your identity today! Signing up is quick & easy

Remember, 1-in-4 Americans are the victim of identity theft. It's not a matter

of if you'll become a victim, it's when...