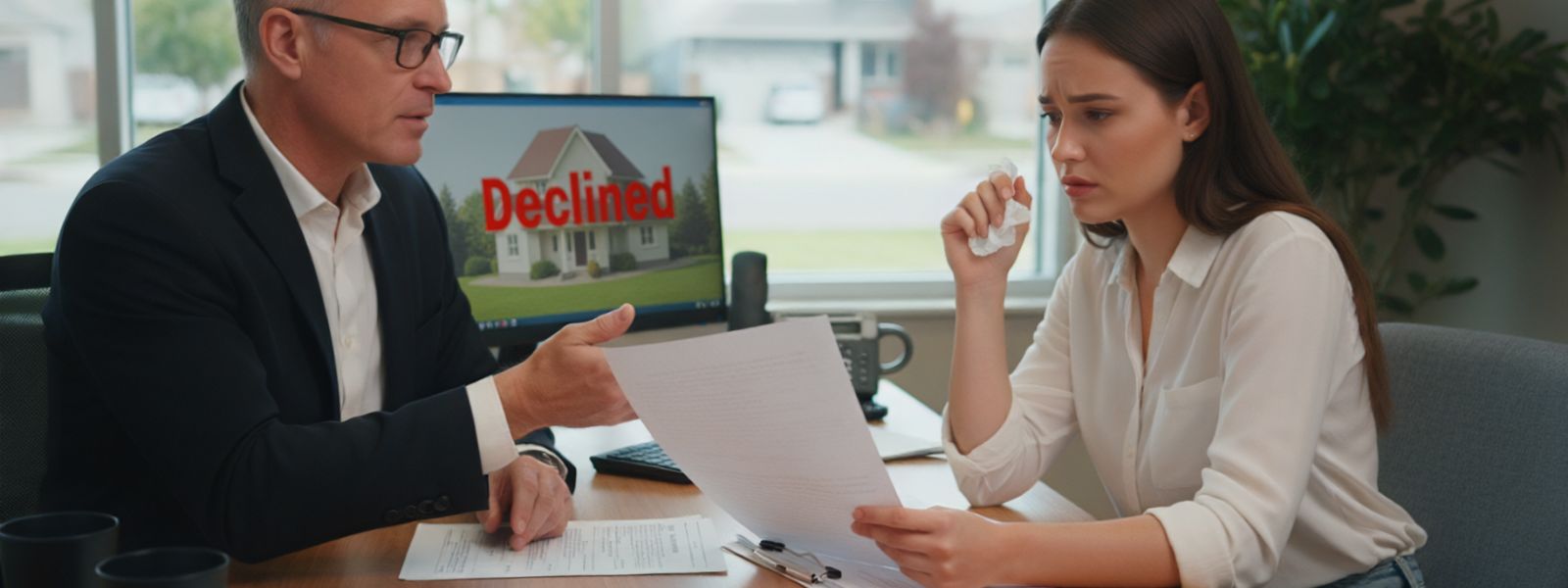

If you’re a young adult just starting out, there’s a good chance you’ve heard the frustrating phrase, “You don’t have enough credit history.”

Not bad credit, not irresponsible spending — just not enough history. Or maybe you find yourself with little to no credit history later on in life.

Welcome to the world of thin credit and no credit, where doing nothing wrong can still hold you back. The good news? This is one of the easiest financial problems to fix if you start early and follow some simple guidelines.

What Is No Credit and Thin Credit?

Before you can build credit, you need to know where you stand.

No credit means you have little to no credit history at all. Lenders have nothing to evaluate because you’ve never used credit accounts.

Thin credit means you have a credit file, but it’s very limited. Maybe you have one account or a short credit history that doesn’t show enough information yet.

These are common situations for young adults, college students, recent graduates, first-time borrowers, and anyone new to credit.

Both no credit and thin credit can make it hard to:

- Get approved for apartments and rentals

- Qualify for loans and credit cards

- Secure lower interest rates

- Pass certain employment background checks

Why It’s Important to Build Credit Early

Your credit score doesn’t just affect upcoming purchases — it shapes your financial future. A strong credit score opens doors only accessible to those with a proven track record of financial responsibility.

Building credit early allows you to:

- Prove creditworthiness to lenders

- Access better interest rates over time

- Avoid the need for co-signers

- Gain financial independence faster

Time is one of the most powerful factors in a healthy credit profile. The earlier you start, the more time your credit score has to grow. Plus, establishing good habits early on sets the groundwork for success throughout your life.

How to Start Building Credit the Smart Way

There’s no need to panic about building your credit quickly — the smartest strategies are simple and controlled. These four tips can help you get started when building a strong credit history:

- Open a Starter Credit Card: A student credit card or secured credit card can help establish credit history when used responsibly. Be sure to keep credit utilization low and pay on time.

- Become an Authorized User: Being added as an authorized user on a trusted family member’s credit card account can help you benefit from their positive payment history.

- Pay Every Bill On Time: Payment history is one of the biggest factors in your credit score. Even one late payment can hurt your score.

- Monitor Your Credit: You can’t protect or improve what you don’t see. Credit monitoring helps you track progress and catch problems early — and these “soft inquiries” won’t negatively impact your credit score.

Why Identity Theft Protection Matters When You’re Building Credit

Many young adults may not realize that identity theft can damage your credit score before you even start building it. Fraudulent credit accounts, loans, or hard inquiries could have disastrous results on your financial life, destroying early credit-building progress or creating unauthorized debt. If fraud occurs, it could take months or years to repair your credit.

Thankfully, early identity protection can make a world of difference. There are even options for people who are just getting started. IDSeal’s Essential Plan provides basic identity theft protection, plus Financial Transaction Monitoring, to help you stay informed and in control as you build credit.

Start Building Credit Safely

Having thin credit or no credit history isn’t a failure — it’s just the starting line. The choices you make now can shape your financial health for years to come. By building credit responsibly and implementing identity theft protection early on, you can give yourself a major advantage. That’s why there’s no better time to get IDSeal, so you can protect your identity while you safely build credit.

Start protecting your identity today! Signing up is quick & easy

Remember, 1-in-4 Americans are the victim of identity theft. It's not a matter

of if you'll become a victim, it's when...